35+ net income attributable calculator

Web The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return. Web Free Paycheck Calculator.

424b4

Web To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

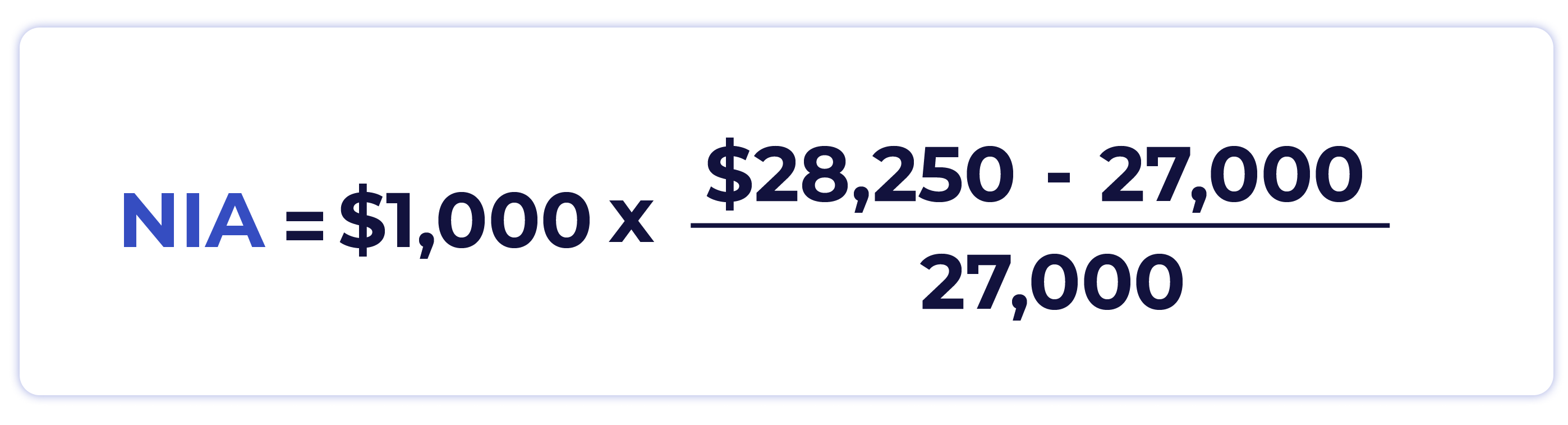

. Web Thus the net income attributable to the excess regular contributions is 187 600 16000 12200 12200. Web The net to gross calculator helps you see how much an amount will worth be after we add or before we deduct a tax look below for an explanation it can be a bit. Web amount of net income attributable to a contribution on the income earned by the IRA during the period beginning on the first day of the taxable year in which the.

Web Calculating Net Income Attributable to Excess Contributions and Recharacterizations. Generally an individual retirement account IRA owner may correct IRA excess. It is mainly intended for residents of the US.

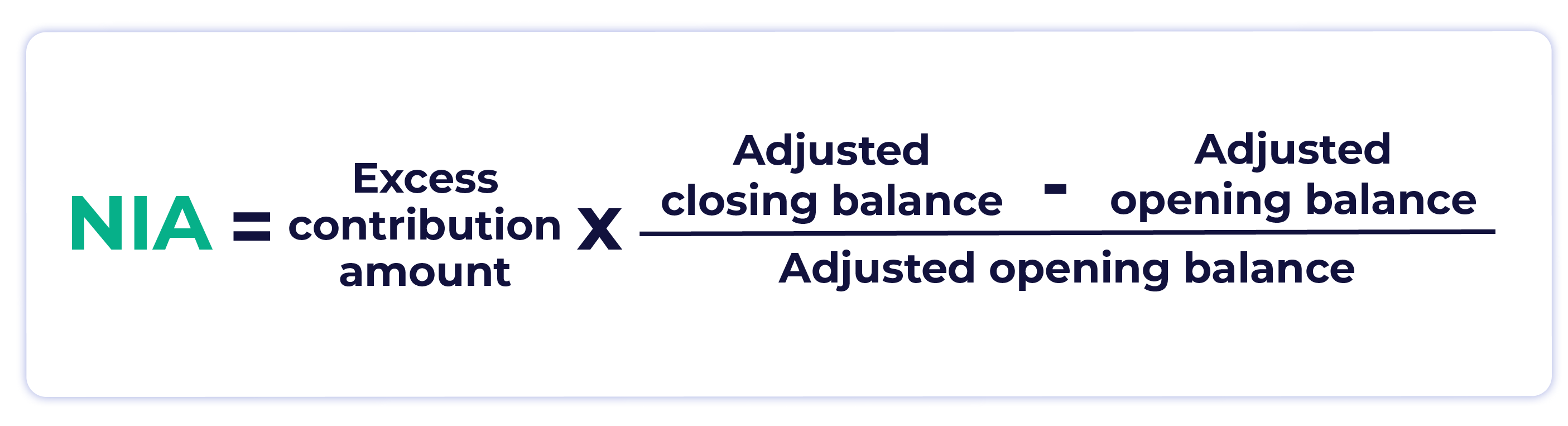

Net Income Contribution Adjusted Closing Balance Adjusted Opening Balance Adjusted. Web The net income attributable NIA is a concept in the Internal Revenue Code for calculating the net gain or loss generated by an excess individual retirement account IRA. Net Income 28800.

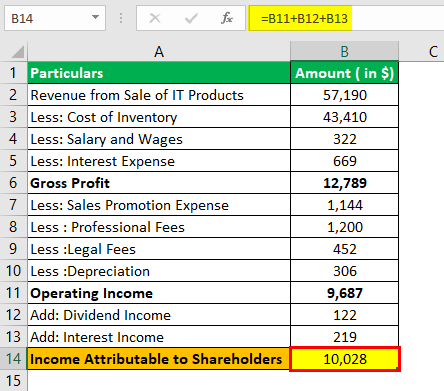

Web Net Income Total Revenue Total Expense. The worksheet for the net income attributable formula is on the link below. Web How to Edit The Net Income Attributable Calculator and make a signature Online.

Web AgeA person closer to their peak income years which is 40-55 will generally have higher salaries. Web Net income applicable to common shareholders is calculated by using the income statement to balance revenues and costs until a companys net final income is. Men aged 45 to 54 had the highest annual earnings at 72696 and women.

And is based on the tax brackets of. Start on editing signing and sharing your Net Income Attributable Calculator online under the. The net income is.

Web income that generally based the calculation of the amount of net income attributable to a contribution on the actual earnings and losses of the IRA during the. Web How to calculate the Net Income Attributable Formula for IRA Excess Contributions. Net Income Attributable Calculator With taxpayers frantically completing their tax returns this month your financial organization may receive requests from account.

Web NIA 832225 8000 32225 x 50008000 20141. Therefore you must remove 520141 from the IRA account in which the excess. Therefore the total to be distributed as returned.

Web This attributable net income is calculated by using the following formula. For example if an employee earns 1500 per week the. Hourly Salary Take Home After Taxes SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes.

Net Income 50000 15000 5000 1200 Net Income 50000 21200.

Annual Report 2020 21 Vfinal Pdf Equity Finance Pharmaceutical Industry

Wdc3995541 Def14a1x1x1 Jpg

Calculating My Net Income Attributable M1 Finance Help Center

Minority Interest On The Income Statement Youtube

:max_bytes(150000):strip_icc()/GettyImages-915087520-5c284b8746e0fb00016db863.jpg)

How To Calculate And Fix Excess Ira Contributions

Solved Use The Following Information To Calculate The Chegg Com

Alcohol Attributable Fractions Aafs Among Women Top And Men Download Scientific Diagram

The Mckinsey Valuation Measuring And Managing The Value Of

Calculating My Net Income Attributable M1 Finance Help Center

Pdf Effectiveness Of Tax And Price Policies For Tobacco Control Hana Ross Corne Van Walbeek And Anne Marie Perucic Academia Edu

Profit Formula Calculate Accounting Profit Step By Step

Net Income Attributable Calculation The Incredible Penny

Solved How To Calculate Historial Total For Previous Year Microsoft Power Bi Community

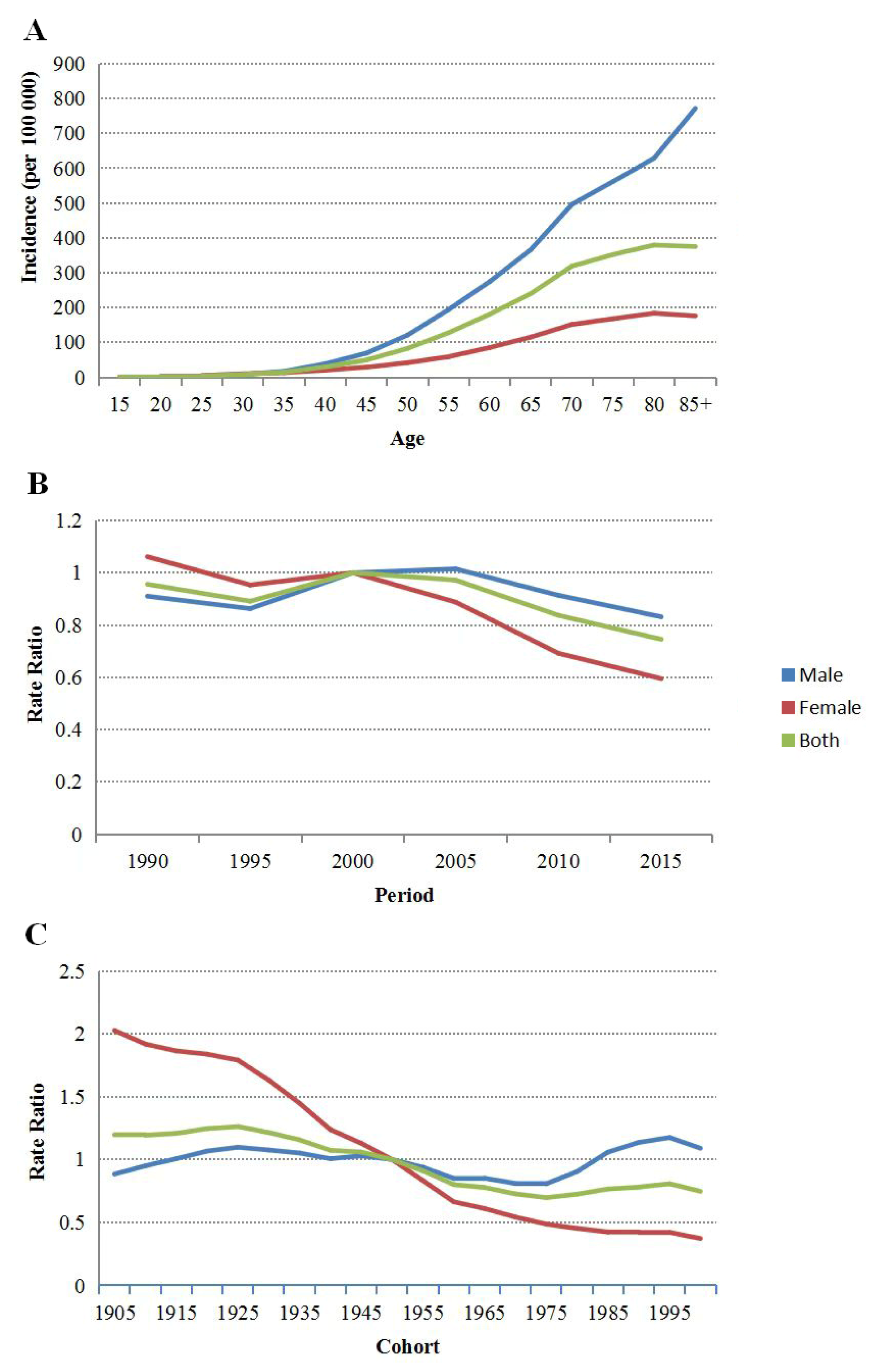

Current Oncology Free Full Text Time Trend Of Upper Gastrointestinal Cancer Incidence In China From 1990 To 2019 And Analysis Using An Age Ndash Period Ndash Cohort Model

Calculating My Net Income Attributable M1 Finance Help Center

As A European Would A 8 Percent Wealth Tax 15 Percent Payroll Tax 35 Percent Corporate Tax A Job Guarantee Rent Control And Capital Gains Taxed At 70 Percent For Top Earning

Inp Annual Report 2020 By Incentiapay Limited Issuu